Nine months into the fiscal year, the federal deficit has topped $1 trillion for the first time.

The imbalance is intensifying fears about higher interest rates and inflation, and already pressuring the value of the dollar. There's also concern about trying to reverse the deficit - by reducing government spending or raising taxes - in the midst of a harsh recession.

During the past administrations we generally had a plan to balance the budget. Yes, those plans were often ill conceived and unrealistic, but there usually was a plan. At one point in recent past we actually had a surplus (and the Treasury was even considering retiring the long bond.)

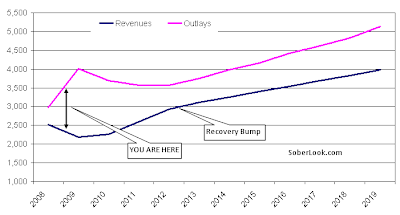

These days however the administration simply doesn't have a plan, not even years into the future. Based on the data from the Congressional Budget Office, the budget will stay out of balance for at least the next 10 years and beyond. Below is the administration's projected budget - in the foreseeable future the federal government plans to spend far more than it takes in.

At least the administration is not trying to pretend that it's possible to spend as much as planned and somehow balance the budget. The US government is not just projecting it will run a deficit in years to come. But what's amazing is the plan is to actually widen the deficit over time (even as we get past the credit crisis). This of course assumes a nice bump in tax revenue from the "economic recovery" that will definitely be here right on time. Without the "bump", the federal budget will make California look like a penny pincher.

So when the Washington Post says this could create a problem for interest rates and the dollar, what exactly do they mean?

Here is what the outstanding government debt pile will look like in years to come (again assuming that nice bump from the supposed recovery). And this doesn't even include the government bonds held by the Social Security Fund or the US Postal Service. Almost $15 trillion by 2019 and no end in sight.