JPMorgan recently conducted its MBS (mortgage backed securities) investor survey. The key questions were focused on the Fed, as the next policy steps will be particularly critical for the MBS market. Let's look at the responses to two of the questions.

1. Identify the most likely policy course at the next FOMC meeting.

62% believe there will be some form of an easing action. Interestingly this number is lower than Goldman's proprietary model assessment of 75%. But consistent with that earlier post there is 2:1 expectation that this easing will be an extension of Operation Twist rather than some outright balance sheet expansion (QE3).

|

| Source: JPMorgan |

2. Assign the odds to the easing action involving MBS purchases, no matter what the program is. Somewhat surprisingly half the participants believe the chances are now over 40%. Only 8% of MBS investors believe the chances are below 20%.

|

| Source: JPMorgan |

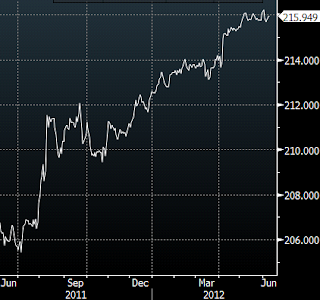

Of course it could be wishful thinking, but that would indeed be good news for MBS investors, as any indication of such purchases will further improve the value of these securities. However even without any Fed action, MBS paper has done reasonably well as shown by the MBS total return index below.

|

| JPMorgan MBS Index that tracks the total return of the fixed-rate mortgage-backed securities issued by the U.S. agencies FNMA, FHLMC, and GNMA (Bloomberg) |

The index is up 1.6% YTD and 4.6% from a year ago - not bad for securities yielding between 25bp and 300bp depending on the maturity. The question of course remains whether such action will help improve US economic growth by lowering mortgage rates even further. The 30-year mortgage rate across the US has already hit another record low last week and people who refinanced at 4% or even lower are once again thinking about refinancing.

|

| 30y fixed mortgage rate (Bankrate.com) |

Currently there is roughly a 200bp spread between the 30-year mortgage rate and the 10-year treasury. The Fed's goal would be to compress this further by flattening ("twisting") the agency curve (see FNMA curve below) while selling more 2-year notes or even dumping shorter term MBS to keep the balance sheet constant.

|

| FNMA actives curve |

The Fed may be able to tighten the spread to treasuries another 25-50bp, but beyond that the central bank would be buying securities with such a low spread/yield that it will be nearly impossible to sell in the future without taking a loss.

Unfortunately the Fed's options are so limited, this may be the most impactful action they can take at this stage. And that explains why a number of the JPMorgan survey participants assign a significant probability to MBS being a part of the next easing program.

SoberLook.com