We now have a sample of four California municipalities that have or are about to default.

NYTimes: - As San Bernardino, Calif., moved toward bankruptcy this week, municipal bond analysts were questioning how widespread the fiscal distress may prove to be, but were not predicting a wave of defaults.Are there common trends shared by these areas that made them more vulnerable? Let's take a look at some demographics compiled by JPMorgan.

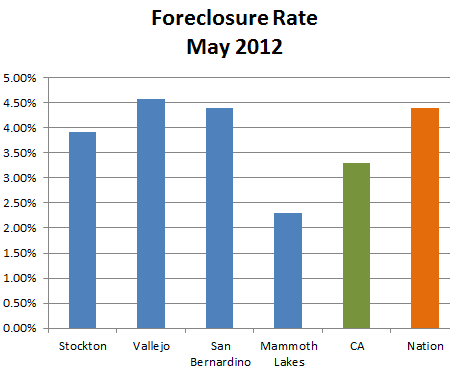

San Bernardino’s vote to authorize a bankruptcy filing came after filings this summer by the California cities of Stockton and Mammoth Lakes. Those cities were following Vallejo, which emerged from bankruptcy in 2011, after a three-year struggle to reduce its debts to investors, retirees and others.

It seems that population growth, unemployment, poverty, and the housing crisis (all reducing tax revenues via declines in sales and property taxes) make these cities/areas stand out. Other issues JPM analysts point to include unusually high personnel and pension costs.

There are clearly multiple other municipalities across the US with these sorts of demographics. Does that mean we are going to see more defaults? The muni debt markets are simply shrugging these off as a set of isolated cases - a tiny portion of the massive municipal bond market.

NYTimes: - Over all, investors in municipal debt showed little sign of concern about the woes of either California or any other states. On Thursday the interest rate on the highest-quality 30-year municipal bonds fell below 3 percent for the first time ever, according to Daniel Berger, a senior market strategist at Municipal Market Data.In fact investors these days love the riskier, lower rated municipal bonds - exactly the sorts of bonds issued by the San Bernardino-types across the nation. The chart below shows shares outstanding (indication of fund inflows) for Market Vectors High Yield Municipal Index ETF (ticker symbol HYD). Shares outstanding index has gone vertical recently. San Bernardino, Stockton? Investors don't seem to care.

|

| HYD shares outstanding |

SoberLook.com