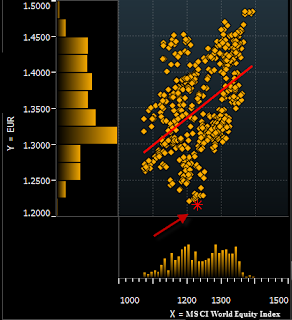

The euro has completely decoupled from other financial instruments that would be classified as "risk-on" assets. Risk-on/off sentiment changes have dominated global market dynamics for several years (see this write-up from Attain Capital for an overview). The following scatter plots show EUR levels vs. other risk asset prices over the past couple of years (red asterisk indicates current levels).

1. Global equities:

|

| EUR (dollars per 1 euro) vs. MSCI World Index |

2. "Risk-on" currencies:

|

| EUR vs. AUD |

|

| EUR vs. CAD |

3. Commodities:

|

| EUR vs. Copper |

|

| EUR vs. CRB Commodity Index |

The euro has in fact become the short leg of the "carry trade", which is where the dollar was some three years ago.

SoberLook.com