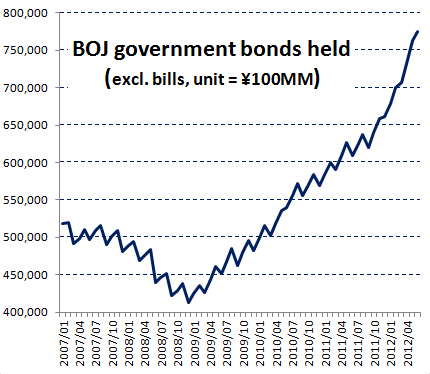

Bank of Japan continues to pursue an aggressive and prolonged monetary easing via its QE program. The asset purchasing program has been in place since 2009 but has been accelerated this year. The latest JGB holdings are equivalent to about $1 trillion (excluding bills) vs. the Fed's portfolio of treasury notes and bonds of $1.6 trillion plus some $0.9 trillion of MBS. So the BOJ has "room" to catch up to the Fed.

The purchases are starting to have some impact, as Japan is slowly pulling out of its nasty deflationary hole. The latest CPI (ex food and energy) is still negative, but not nearly as bad as it was a couple of years ago. Given years of deflation, it may take much more easing before prices begin to stabilize.

|

| Japan natl. CPI ex food and energy |

SoberLook.com