Agricultural commodity futures prices continue to march higher in response to one of the worst North American droughts in decades. It has become clear that the genetic engineering technology developed to help crops better withstand drought will be ineffective against these weather conditions. Efforts to stabilize crop yields in many areas have failed.

|

| Wheat |

|

| Soy |

|

| Corn |

Some analysts have pointed out that it may take time before these elevated food prices feed through into the CPI measures. But in the fast moving global markets an exogenous shock of this magnitude propagates quite quickly.

Bloomberg/BW: - Brazil’s inflation unexpectedly accelerated this month, reinforcing investors’ bets that the central bank will soon end a cycle of interest rate cuts that has taken borrowing costs to a record low.

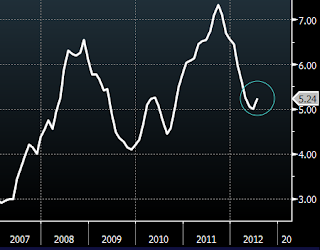

Consumer prices as measured by the IPCA-15 price index rose 0.33 percent in the month through July 13, exceeding all 42 analyst estimates in a Bloomberg survey whose median forecast was for a 0.18 percent increase. The annual inflation rate accelerated for the first time in 10 months to 5.24 percent, the national statistics agency said in Rio de Janeiro today.

|

| Brazil IPCA-15 price index (YoY) |

And at least a portion of this shock was clearly driven by rising food prices.

GS: - The food-driven supply price shock and the fading impact of tax cuts on the purchase of durable goods interrupted the ongoing deceleration of yoy [Brazil] inflation. This is likely to be noticed by the central bank and adds weight to the view that the current easing cycle is now approaching the end.As discussed before, this is a dangerous development for a couple of reasons:

1. Food inflation will prevent emerging markets nations's central banks from stimulating their economies in an environment of a global slowdown. This could lead to stagflation that impacts global growth.

2. Food inflation was a major contributor to the "Arab Spring" movement and will have a destabilizing effect on a number of economically strained nations that depend on food imports (including Iran).

SoberLook.com