The spectacular growth in student loan balances has been driven by college tuition increases as well as...

|

| Source: Barclays Capital |

higher overall college enrollment.

|

| Source: Barclays Capital |

But the problem is not only the size and the rapid expansion of the student loan amounts outstanding, but also the increasing credit risk.

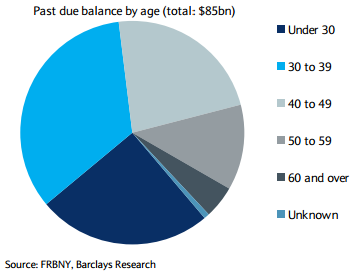

Another worrying sign is that delinquencies in the 40-49 age group are disproportionately high. Seems some borrowers basically give up on this debt during the years of their prime earning potential. Clearly the weakness in the labor market is not helping.Barclays Capital: - The Federal Reserve, with the help of Equifax, created an extensive data set providing a snapshot of student debt in Q3 2011 that was released in March 2012. According to this study, 14% of all borrowers had past-due balances, and 27% of those who had entered the repayment cycle had past-due balances. Almost half of all student borrowers were not making payments; 47% were either still in school or in deferral, forbearance, or grace periods as of Q3 2011. This means that a significant number of borrowers who are not currently in repayment are set to enter the payment cycle in the next few years. Given the weak labor market and increasing dropout rates, there is little reason to think that their delinquency rates will lower the current national average.

Total borrowers by age:

|

| Source: Barclays Capital |

Delinquent borrowers by age:

|

| Source: Barclays Capital |

The older borrowers present a problem as well.

Barclays Capital: - Currently, 15.5% of the outstanding student loan balance is held by borrowers 50 and older, and 4.2% is held by those 60 and older. These borrowers account for a larger share of the past-due balance outstanding, with those over 50 responsible for 16.9% of the past-due balance and those over 60 accounting for 4.8%. The average student debt burden for borrowers over 60 is $18,250, and much of it has not been paid on the traditional schedule (most student loans have a 10-year repayment plan). There is little reason to think that someone in retirement will suddenly attain the means or motivation to make on-time payments after having gone years without making them.If student loan balances continue to grow at the current rate, the federal government will be faced with over a trillion of exposure and rising default risks a few years down the road (particularly when half the borrowers who are currently deferring payments will be required to begin paying interest).

SoberLook.com