The US employment numbers this morning generated a sharp rally in risk assets, with crude oil rising 3.5%, S&P500 up 1.8%, copper up 1.6%, and Brazilian Real up 90bp. It's worth taking a quick look at what in this employment report is causing such euphoria and whether it is justified.

The markets have focused on the private payrolls increase, which was 62K higher than the forecast. In particular it was the pickup in manufacturing payrolls of 25K vs 10K expected.

|

| Private payrolls (in thousands, MoM) |

This is certainly great news, but unfortunately this report is not as strong as the markets' reaction indicates. Here are the reasons:

1. The prior month in private payrolls was revised down by 11K. That's not an insignificant revision.

2. The unemployment rate actually went up from 8.2% to 8.3% and underemployment (U6) went up from 14.9% to 15%. In fact, this is a third month in a row that saw an increase in U6.

3. Hourly earnings were lower than expected (0.1% vs 0.2%). The YoY growth in hourly earnings is 1.7%, the lowest since 2010. This is not positive for consumer spending.

4. Growth in temp payrolls continues to be significantly stronger than in permanent jobs. It tends to indicate lack of confidence among employers.

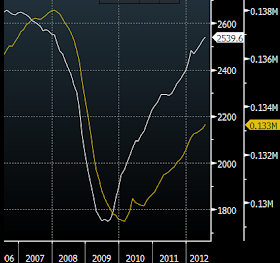

|

| Temps payrolls (white) vs. total payrolls (yellow) (source: Bloomberg) |

5. Manufacturing payrolls increase was driven to a large extent by fewer auto plants being idled for retooling than is usual for this time of the year. It's basically a seasonal glitch that may end up being reversed in August.

Bloomberg: - Factory payrolls increased by 25,000, more than twice the survey forecast of a 10,000 increase and boosted by a 12,800 pickup in employment at makers of motor vehicles and parts.6. Another survey of employment also conducted by the government called Household Employment Survey seems to contradict the headline number.

The figures may have reflected fewer shutdowns at automakers for annual retooling related to the new model year, indicating the jump will be reversed this month. Chrysler Group LLC and Ford Motor Co. (F) are among companies that said they would idle fewer plants.

Stateseman.com: - [in the Household Survey the] government workers ask whether the adults in a household have a job. Those who don't are asked whether they're looking for one. If they are, they're considered unemployed. If they aren't, they're not considered part of the work force and aren't counted as unemployed. The household survey produces each month's unemployment rate.This other survey indicates a 195K loss of payrolls. To be fair, the household survey at times also showed higher job growth than the more commonly used number. Nevertheless this discrepancy is large enough to question the veracity of the headline number.

The Telegraph: - Stephen Stanley at Pierpont Securities: "It's marginally better on the balance. More importantly we have a drop in household employment, which is not such good news. Even with the better-than-expected payroll number, it's not sufficiently big enough to change the big-picture view. The economy is growing but not at a satisfactory rate to bring down unemployment."

SoberLook.com