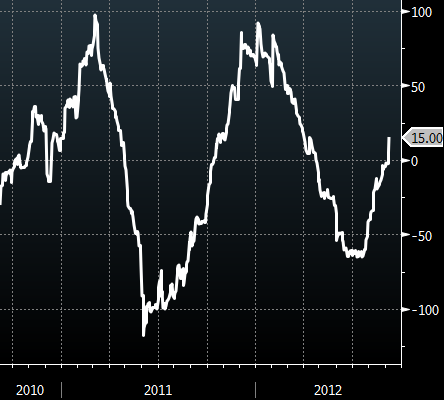

The Citi Economic Surprise index was fairly accurate in pointing to a US slowdown in the first half of 2012. One therefore should not dismiss the recent reversal in the indicator's trend. The index just went into the positive territory in spite of today's poor employment report.

Washington Post: - While today’s jobs data trailed forecasts, better-than- projected reports over the past three months have pushed the Citigroup Economic Surprise Index for the U.S. to an almost five-month high. The index, which measures how much data is beating or missing the median estimates in Bloomberg surveys, climbed to 15 today after yesterday rising above zero for the first time since April.

|

| Citigroup Economic Surprise Index - United States (Bloomberg) |

The contributors to the recent uptick include positive surprises from ISM Non-manufacturing Composite, Initial Jobless Claims, US Factory Orders, various housing indices (15% YoY in pending home sales for example), chain store sales, and auto sales. Growth in the US is clearly subpar, but the economy is not headed for a "double-dip" as many had predicted. People also need to come to terms that slow growth, driven by weak global demand, is the "new normal".

SoberLook.com