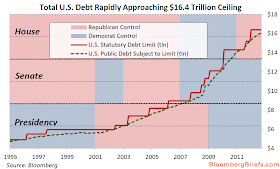

The topic of the US debt ceiling is covered widely in the media and the blogosphere. It is often accompanied by a great deal of finger pointing. Let's try to take an unbiased look for a second. The map below shows how total government debt level increased under either the Democrats' or the Republicans' controlled White House, the Senate, or the House.

Both parties had a hand in this nightmare - potentially for different reasons. The long-term risks to the US prosperity from these debt levels are enormous, particularly given slow economic growth possibly for years to come. But there are also short-term risks. None of this is news to most people, but it is still important to point out the following facts:

Michael McDonough (Bloomberg): - A rapidly increasing U.S. debt load, approaching the $16.4 trillion ceiling, amplifies downside risk. In 2011, failure to raise the debt ceiling led to the first-ever downgrade of the U.S. by Standard & Poor’s. This year, U.S. debt has increased by an average 0.6 percent a month. At that rate, the current ceiling may be breached by January, risking further downgrades and substantial volatility in financial markets.

The MSCI World Index dropped almost 20 percent between April 18, 2011, when S&P placed the U.S. on negative outlook, and Oct. 4, 2011, its year-low; 30-day volatility rose to 29.4 from 14.6 during the same period. The U.S debt ceiling has been raised 17 times since 1993 by an average of 8.5 percent. Four of those increments came during Bill Clinton’s presidency. Seven were during President George W. Bush’s time in office. Since President Obama took office, the debt ceiling has been increased six times.

SoberLook.com