Lee Adler has a nice post (here) on the latest employment data, pointing out that some of the seasonal adjustments in the government report are flawed. That's in part why there was so much confusion when the numbers came out yesterday (post).

It is therefore sensible to look at other government statistics without the seasonal adjustments. One such set of numbers is the latest report from the Fed on consumer credit which showed a spike in borrowing by US consumers.

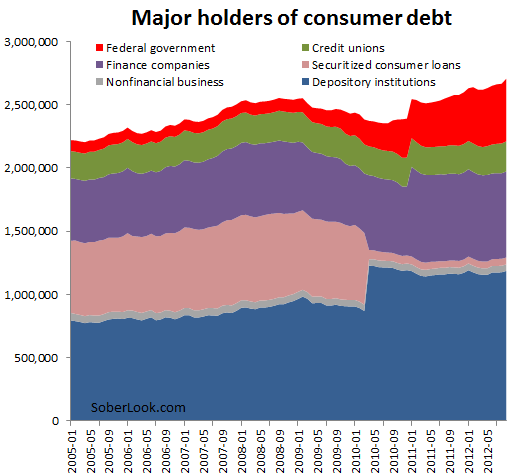

Reuters: - U.S. consumer credit rose $18.12 billion, the biggest gain since May, following July's revised $2.45 billion decline. Revolving credit, which mostly measures credit-card use, climbed $4.2 billion. Nonrevolving credit, which includes student and auto loans, rose $13.92 billion.This increase looks strong, but let's take a look at who the credit providers are and how their holdings changed over time - without the seasonal adjustments that add noise to the data. The chart below shows that 25% of the increase in August is coming from banks and 6% from credit unions. That's mostly due to an increase in credit card debt (remember this data does not include mortgages). The 9% increase in holdings by finance companies is from auto loans. And then there is the elephant in the room - 58% of the increase in consumer credit came from the federal government. That is all student loans. For some reason the media is refusing to zero in on this.

Here is an example of how even the more sophisticated financial journalists seem to miss the point.

Reuters (same report as above): - Credit has been expanding almost continuously since mid-2010 as the country recovered from the 2007-2009 recession. The decline in July was the first drop since August of last yearBut if one plots the holders of consumer debt over time (again without the seasonal adjustments), a familiar picture emerges. Yes, consumer credit has been growing since the recession, but all of the growth came from the federal government and not from credit institutions. In fact without the rapid increase in government student loans, consumer credit would still be down from the end of the recession. That explains why consumer spending has been subdued in spite of growth in consumer credit.

|

| Source: FRB (NSA) |

Celebrating these large increases in consumer credit is premature because these numbers do not mean vigorous retail credit expansion by financial institutions. Nor are they pointing to increases in consumer spending. Instead, consumer credit growth these days goes to fund the relentlessly rising cost of higher education, which the US consumer can hardly afford at this time (see discussion).

SoberLook.com