The great "Sandy debate" is on. US economic data is coming in weaker than expected and some argue that it can't all be explained by the hurricane. Case in point is the initial jobless claims report from last week - see chart.

Econoday: - Hurricane or not, it's hard to ignore an incredible 78,000 surge in initial jobless claims for the November 10 week to 439,000. Adding to the pressure is a 6,000 upward revision to the prior week to 361,000. The four-week average is up a very sizable 11,750 to a 383,750 level that is more than 15,000 above month-ago levels which does not point to improvement for November payroll growth or the unemployment rate.Another example is the US industrial production, which clearly looks like it has stalled (chart below).

So far the explanation has been that Hurricane Sandy disrupted production in late October, causing this decline.

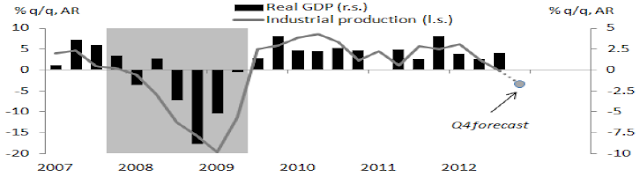

NYTimes: - Industrial production fell unexpectedly in October because of Hurricane Sandy, the Federal Reserve reported on Friday, but factory growth appeared at a standstill even aside from the storm.Does that mean we should dismiss these results as temporary? Some suspect that the US industrial output would have been weak event without the hurricane. DB economists also think that the weakness will persist through November, dramatically lowering the US GDP (below 1.3% annualized). According to DB the quarter-over-quarter changes in industrial production (IP) have an 83% correlation to the GDP. And the bank is forecasting a material Q4 decline in IP. The recent weakness may not be as transient as some expect.

Production at the nation’s mines, factories and refineries contracted 0.4 percent last month, after a 0.2 percent increase in September, the Fed said. It said the storm, which hit the East Coast at the end of October, cut output by nearly 1 percentage point. Utilities and producers of chemicals, food, transportation equipment, and computers and electronic products were the most affected, it said.

DB: - If the November decline [in IP] matches that of October, the annualized change [in IP] will be -3.4%. While there have been occasions in recent history when industrial production contracted but real GDP growth remained positive, weakness in the former is generally an ominous sign for the latter.

|

| Source: DB |

SoberLook.com