Last year we discussed just how frothy the US fixed income valuations have become (here and here). Now in a matter of several weeks, the US bond markets have wiped out a year's worth of gains and then some. That includes all the interest income.

In fact, according to JPMorgan, May saw the worst global bond performance since early 2004.

|

| Source: JPMorgan |

All of a sudden the realization has set in that rates may in fact rise and the multi-year bond rally may at some point come to an end. Google Trends shows a spike in searches related to rates rising.

|

| Google search frequency for rates rising |

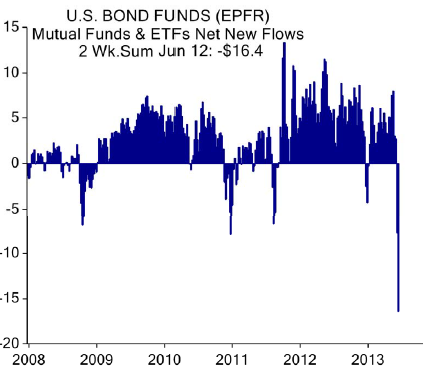

Not surprisingly bond fund and ETF outflows spiked, as investors began abandoning the beloved fixed income funds in droves.

|

| Source: ISI Group |

In the next post we will discuss the so-called "Great Rotation", which predicts that these outflows should end up in the equity markets.

SoberLook.comFrom our sponsor: