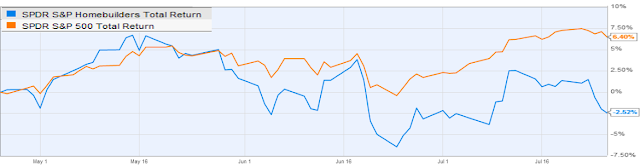

Since the talk of scaling down the Fed's securities purchase program started, homebuilder shares have been underperforming the broader market. That underperformance has in fact increased over the last few days, in spite of strong homebuilder optimism numbers.

|

| Source: Ycharts |

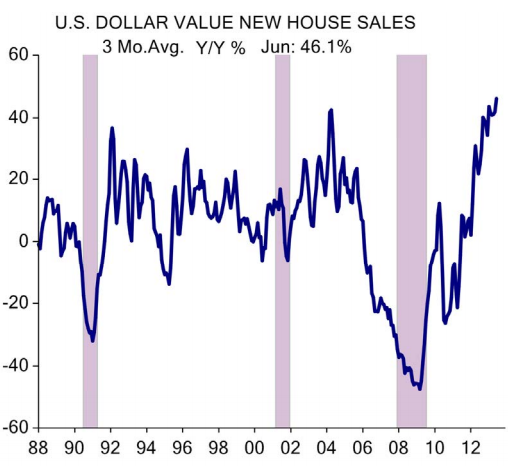

This seems to contradict the fact that US house sales in total dollar terms are now at record levels.

|

| Source: The ISI Group |

And D.R Horton, the largest US homebuilder by volume, recently beat analysts earnings estimates with strong construction volume and higher prices charged.

Reuters: - Homebuilder D.R. Horton Inc (DHI.N) reported a better-than-expected profit as it sold more homes at higher prices in quarter ended June.The market yawned in response, with DHI shares still down 25% in the past 3 months. What's going on?

Demand for homes has remained strong despite a recent rise in mortgage rates as a shortage of homes available for sale has enabled builders to raise prices.

D.R. Horton, which sells homes priced between $100,000 and $600,000, said average selling price rose 15 percent in the third quarter.

Orders — a key indicator for builders, who do not book revenue until they finish a house — rose 12 percent to 6,822 homes.

|

| Source: BigCharts |

According to D.R. Horton's there is "no question" that higher rates have affected demand. Homebuilders have seen a slowdown in order growth.

Bloomberg: - PulteGroup, based in Bloomfield Hills, Michigan, said second-quarter orders fell 12 percent on a lower community count. D.R. Horton said orders increased 12 percent, which was below analysts’ forecast for 28 percent growth, according to Adam Rudiger, an analyst at Wells Fargo & Co. in Boston.Orders are rising, but not nearly as fast as was implied by stock valuations. The equity markets have priced in a significant momentum in residential construction growth over the past couple of years. Now higher mortgage rates are taking some of that momentum out, which is showing up in homebuilder underperformance. It's an interesting consideration for the Fed, as the September decision on securities purchases looms large.

Rising mortgage rates contributed to increased cancellations and a dropoff in traffic in June, according to Fort Worth, Texas-based D.R. Horton. Borrowing costs have surged in the past two months on expectations that the Federal Reserve will scale back bond purchases. The 30-year average fixed mortgage rate was 4.31 percent in the week ended today, up from a near-record low of 3.35 percent in May, Freddie Mac said.

“We got our first indication today that consumers are feeling the effect of rising rates on their purchasing power,” Peter Martin, a San Francisco-based analyst with JMP Securities LLC, said in a telephone interview.

SoberLook.comFrom our sponsor: