The situation in Portugal has taken a turn for the worse. Given the deepening political crisis, last week the finance ministry has requested a delay in the next progress review by the nation's creditors.

Reuters: - Portugal's government has requested a delay in the next regular review of the country's bailout by its creditors due to the "current political situation," the finance ministry said on Thursday.Surprisingly the request was granted. This could be a sign of yet another deviation from the current bailout plan. Furthermore on Friday new anti-austerity rhetoric was heard from the opposition leadership. The socialists are pushing hard to renegotiate Portugal's bailout terms.

The delay is one of the first direct effects on the country's 78-billion-euro bailout caused by a political crisis which erupted last week with the resignation of the finance and foreign ministers.

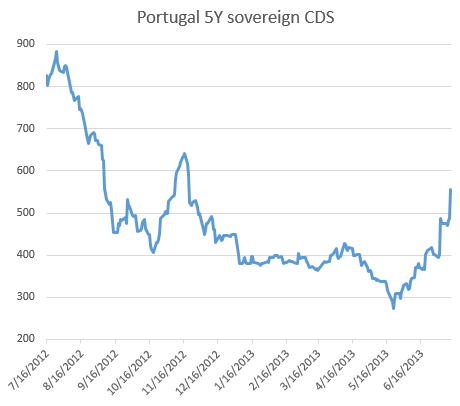

CNBC: - ... the leader of Portugal's socialist opposition, Antonio Jose Seguro, told parliament that Portugal must end its commitment to austerity.Portugal's sovereign CDS spread moved up sharply in response, though it remains below the highs of 2011/12.

"We have to abandon austerity politics. We have to renegotiate the terms of our adjustment program... The prime minister has to recognize publicly that his austerity policies have failed," Seguro said.

Alessandro Giansanti, a senior interest rate strategist at ING, said that Friday's jump in bond yields was in direct response to Seguro's comments. "The socialist party wants to renegotiate the terms of Portugal's bailout agreement, and this has resulted in market jitters," Giansanti told CNBC. "These comments suggest there is an increasing risk there will be a change in the political situation in Portugal, potentially with less tough bailout conditions."

A more worrying sign has been the flattening of the government yield curve. As discussed earlier (see post), it remains unclear if Portugal will qualify for the ECB's bond buying program (OMT). OMT was meant to target "monetary transmission" to reduce the rates on short-term loans. Mario Draghi "promised" to purchase bonds that are 3 years and shorter for those nations who qualify and apply for the program. Without this explicit backstop guarantee however and with political stress rising, short-term yields shot up.

|

| Source: Investing.com |

As a result, the yield curve has flattened.

If the trend continues, the curve will become inverted (see post from 2012) - an indication of "distressed" credit.

Portugal's socialist party is now leading in opinion polls, making this potential renegotiation of the bailout terms a reality. At some point however, Portugal's creditors will run out of patience and the political will to allow the nation to slip yet again. They may end up insisting on private sector participation in the latest debt adjustment. Many are already arguing that current debt levels in Portugal seem unsustainable. And that could mean some form of restructuring of Portugal's government bonds, with haircuts, maturity extensions, coupon reductions, and other wonderful things associated with this process (see discussion).

SoberLook.comFrom our sponsor: