The latest data seem to suggest that China has so far been able to elude the severe economic headwinds faced by other emerging economies. Signs of stability have been around for a few weeks, but the first set of direct evidence came from Markit/HSBC PMI, showing China's manufacturing contraction easing (see Twitter post). The official PMI number (to the extent it can be trusted) confirmed the HSBC's result.

|

| Official China Manufacturing PMI (source: Fung Business Intelligence Centre) |

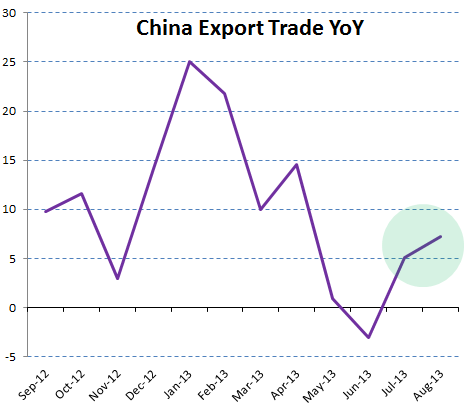

The nation's exports (once again to the extent the official data here can be trusted) unexpectedly picked up last month as well.

Bloomberg: - Overseas shipments rose 7.2 percent from a year earlier, the General Administration of Customs said in Beijing today. That compares with the 5.5 percent median estimate of 46 economists surveyed by Bloomberg News and July’s 5.1 percent gain. Imports rose a less-than-estimated 7 percent from a year earlier, leaving a trade surplus of more than $28 billion.The Fung Business Intelligence Centre reported improvements in China's logistics index (from 52.4 to 52.9), which tends to be a leading indicator of activity. Here are the details.

|

| Source: Fung Business Intelligence Centre |

After a liquidity squeeze forced a sharp selloff in June (see post), the stock market has stabilized for now. The profitability of the banking system has been declining for some time (see Twitter post), but so far we haven't seen any failures as some had predicted. That doesn't mean such an event is off the table - bad assets can be hidden for a long time. But if it were to happen, the government may not let such news see the light of day. Investors seem cautiously optimistic.

|

| Shanghai Stock Exchange Composite Index (source: Bigcharts) |

Perhaps the best indicator of China's recent economic stability comes from outside the country. Australian markets are often viewed as a proxy to China, given the two nations' close trade relationship. The Australian dollar, after touching a multi-year low of around 89 US cents a couple of times, is now back around 92. And the Australian stock market has been tremendously resilient lately, outperforming the S&P500 by 6% over the past two months.

|

| blue = S&P/ASX 200, red = S&P500 |

Putting these facts together paints a picture of the Chinese ecenomy that is not about to "fall out of bed". If this trend can be sustained, it is certainly good news for the global economy. Most importantly this recent stability could provide some cushion to other emerging economies who trade with China - as they grapple with capital outflows driven by the Fed's expected action.

SoberLook.comFrom our sponsor: