US corporate credit markets, particularly high yield bonds, are becoming quite frothy, as risk/reward dynamics continue to worsen. Here are some key indicators:

1. In the last couple of years high yield supply has been massive relative to equities. HY has had no shortage of buyers thus far, but the market is becoming increasingly comfortable with the primary market buyers always being there. Investors are ignoring the fact that such demand may not always be the there.

|

| Source: Barclays Research |

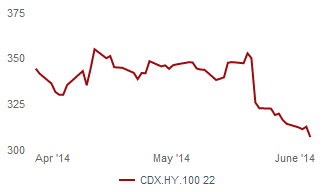

3. Similarly, corporate credit default swap spreads are falling as well. Here is what CDX (index of CDS) spreads have done recently for both investment grade and HY indices.

|

| Investment grade CDX spread; current on-the-run series (source: Barclays Research) |

|

| High yield CDX spread; current on-the-run series (source: Barclays Research) |

4. Valuations in the most leveraged and lower quality portion of the credit spectrum have risen dramatically. Over 60% of corporate bonds rated CCC by Fitch now trade above par.

|

| Source: Fitch Ratings |

To be sure, improving economic fundamentals in the US have reduced default risks considerably. But we are now back to the days when the ability to refinance is taken for granted and current cash flow to service debt is starting to become less relevant. With banks' ability to hold inventory impaired, these markets are becoming quite vulnerable to a sharp correction.

___________________________________________________________________________

SoberLook.comSign up for our daily newsletter called the Daily Shot. It's a quick graphical summary of topics covered here and on Twitter (see overview). Emails are distributed via Freelists.org and are NEVER sold or otherwise shared with anyone.

From our sponsor: