Guest post by $hane Obata

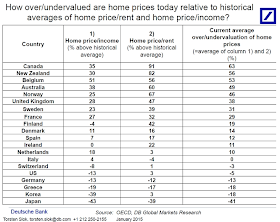

1) Canada’s housing market is 63% overvalued relative to its historical average…

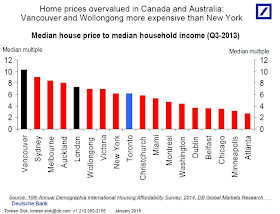

2) Home prices in Vancouver are more expensive than they are in Sydney, London, and New York…

3) “Canada is in serious trouble” because its households never deleveraged…

4) Since 2000, growth in assets held by Canadian banks is as follows…

Personal lines of credit: + ~650%

Credit card loans: + ~400%

Mortgages: + ~250%

Disposable income: + ~100%

5) In Canada, multifamily construction is at record highs…

6) Canadian workers are twice as reliant on housing construction

In conclusion…

- The Canadian housing market is very expensive.

- Median house price to median household income is higher in Vancouver than it is in Sydney, London, and New York.

- Canadian households – unlike their US counterparts – never deleveraged after the financial crisis.

- Credit is growing a lot faster than income is.

- There’s a lot of supply coming onto the market.

- The share of Canadian workers in housing construction is twice what it is in the US.

If rates rise or if commodity prices continue to fall then it’s likely that Canada’s housing market will come under pressure.

_________________________________________________________________________

Sign up for our daily newsletter called the Daily Shot. It's a quick graphical summary of topics covered here and on Twitter (see overview). Emails are NEVER sold or otherwise shared with anyone.

_________________________________________________________________________

From our sponsor, Fitch Solutions: Sign-up for Inside Credit - a weekly wrap-up of noteworthy Fitch content delivered every Friday.

SoberLook.com